Recap: Australian 2022 Main Events

Political

Australian federal election: The Labor party, led by Anthony Albanese, defeats the Liberal/National Coalition Government led by Prime Minister Scott Morrison. Albanese would be sworn in on May 23.

Victoria state election: The incumbent Labor government, led by Premier Daniel Andrews won a third successive four-year term, defeating the Liberal/National Coalition, led by Opposition Leader Matthew Guy. The Greens, other minor parties and several independents also contested the election.

Economy

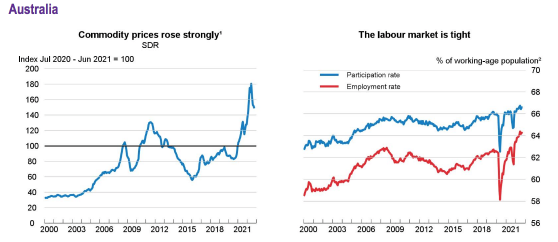

Real GDP is projected to grow by 4% in 2022, 1.9% in 2023 and 1.6% in 2024. Elevated inflation is eroding households’ purchasing power and has prompted the Reserve Bank of Australia to raise interest rates at a rapid pace. As growth slows, the tightness in the labor market is expected to subside. Inflationary pressures will diminish as the labor market cools and supply chain bottlenecks ease. A stronger than expected decline in house prices is a key risk to the growth outlook.

Further monetary policy tightening will be necessary to bring inflation down to the 2-3% target range. Any further fiscal support in response to cost-of-living pressures should be targeted and temporary and maintain incentives for energy savings. Reducing greenhouse gas emissions remains a top priority and will require further action, including investment in renewables and in the transmission network, regulatory changes, structural reforms and higher carbon pricing.

Demographics

- Australia’s population was 25,890,773 people at 31 March 2022.

- The quarterly growth was 124,200 people (0.5%).

- The annual growth was 234,100 people (0.9%).

- Annual natural increase was 130,200 and net overseas migration was 109,600.

Property Market

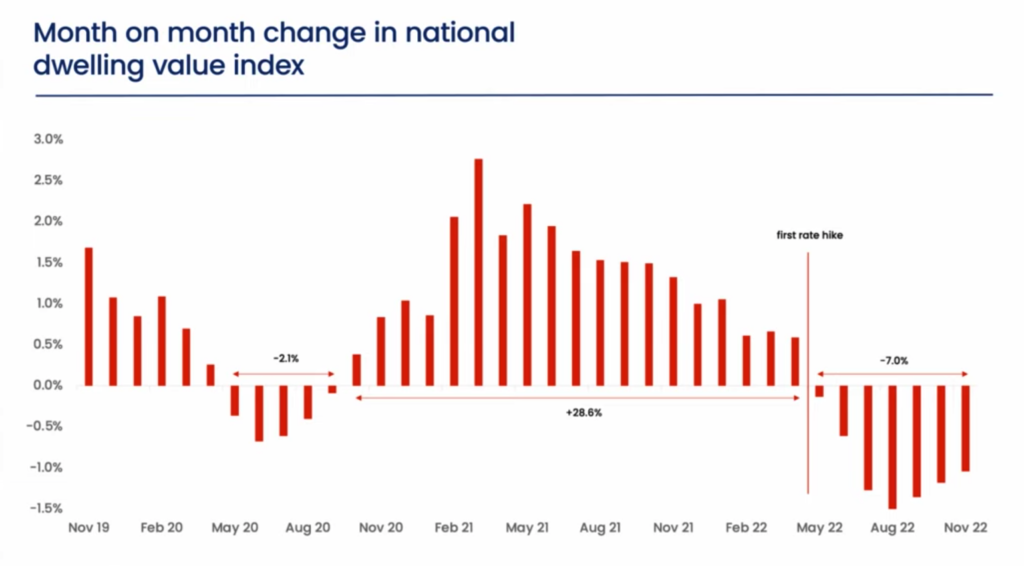

The main factor driving this change was an increase in interest rates. After years of low interest rates, banks began increasing their mortgage rates in late 2021 in an effort to reduce risk from borrowers over-leveraging themselves on property investments and slow down inflation. This sent shockwaves through the market as many investors and home buyers had become accustomed to low-cost borrowing, and were unprepared for such a sudden rise.

The result was a decrease in demand for residential properties, as fewer people could afford to enter the market due to higher borrowing costs. At the same time, there was also an increase in supply as more homeowners put their properties up for sale due to difficulty meeting loan repayments or needing to cash out quickly after losing employment during COVID-19 restrictions. This combination of decreasing demand and increasing supply caused prices to decline across most of Australia’s capital cities.

In addition to falling prices, lenders also tightened their lending criteria by reducing their Loan-To-Value Ratio (LVR) thresholds from 80% down to 70%. This meant that borrowers would have to come up with more money upfront when taking out a loan for property investment or home purchases. Furthermore, new banking regulations required lenders to assess borrowers’ ability to service loans based on higher interest rates than those offered by banks at the time – making it even harder for potential buyers get approved for financing. Conclusion: All of these factors combined created a challenging environment for buyers looking to enter or expand within Australia’s property market in 2022. While prices came off their peak levels, they still remain high compared with historical averages – creating a dilemma for potential buyers who are struggling between wanting take advantage of lower prices but not wanting to overstretch themselves financially with higher borrowing costs. As always though, good research into both local markets and lender policies can help you find ways around these challenges if you are looking at buying property in 2023.

What should you expect in 2023?

It’s difficult to say what will happen in the Australian property market in 2023. This year was a difficult year, with many experts predicting that things will only get worse before they get better.

However, there are some indicators that suggest that 2023 may not be as bad as people are expecting. One prediction is that property prices may stay relatively stable. Prices in the major cities have already been dropping, but the impact of this might not be seen until 2023. This could mean that property values won’t fall much further and will remain steady throughout the year.

Related Posts

- Infrastructure Australia - Frankston in the priority list.

Due to constant population growth in Frankston and Mornington Peninsula, Infrastructure Australia has announced as…

- 2019 Melbourne Property Market Review: What to expect in 2020

The year of 2019 was an unexpectedly solid year for the pessimists on the Australian…

- Should you still buy property during a pandemic?

2020 promised to be a bright year for the Australian property market. There were strong…